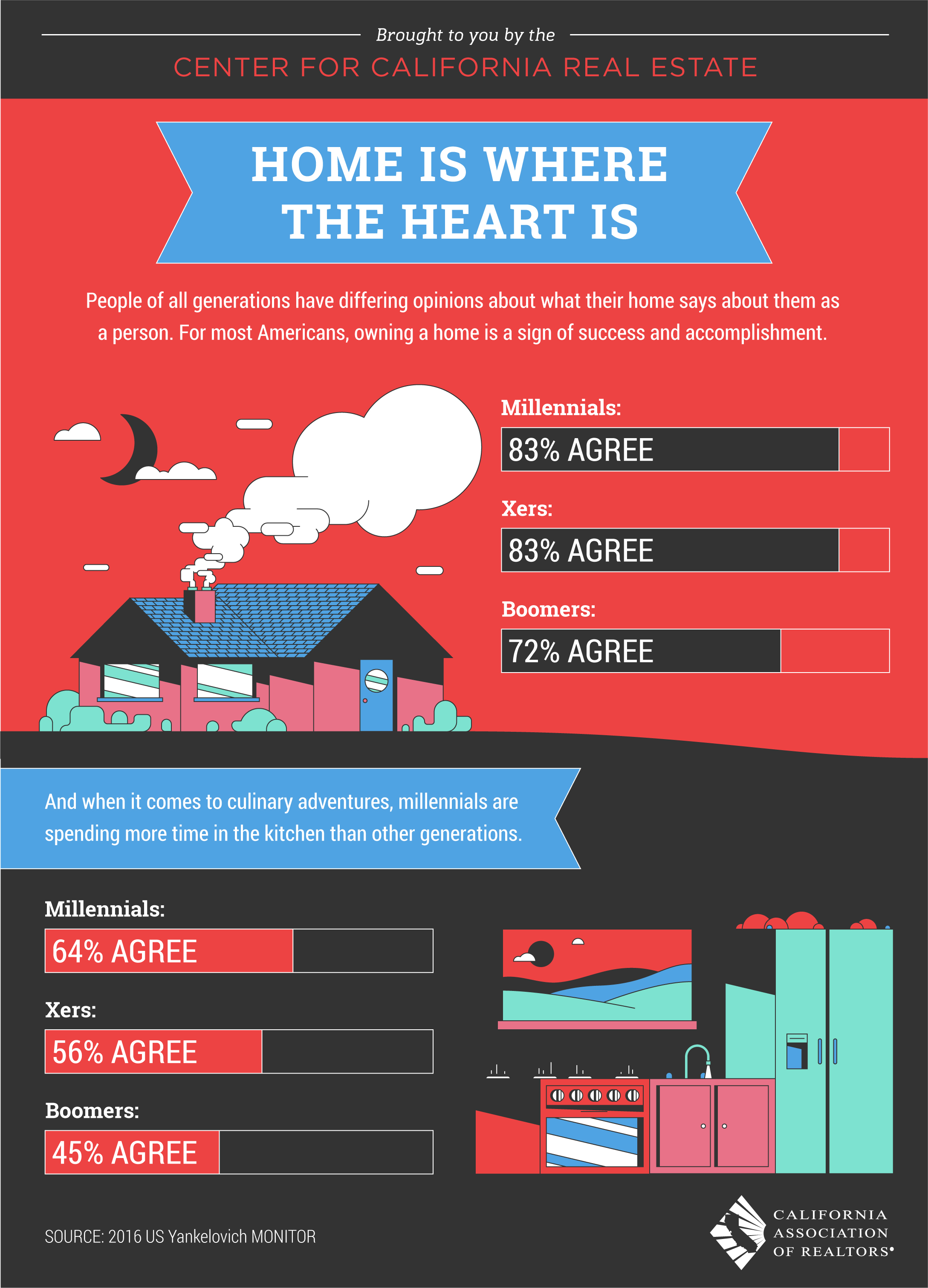

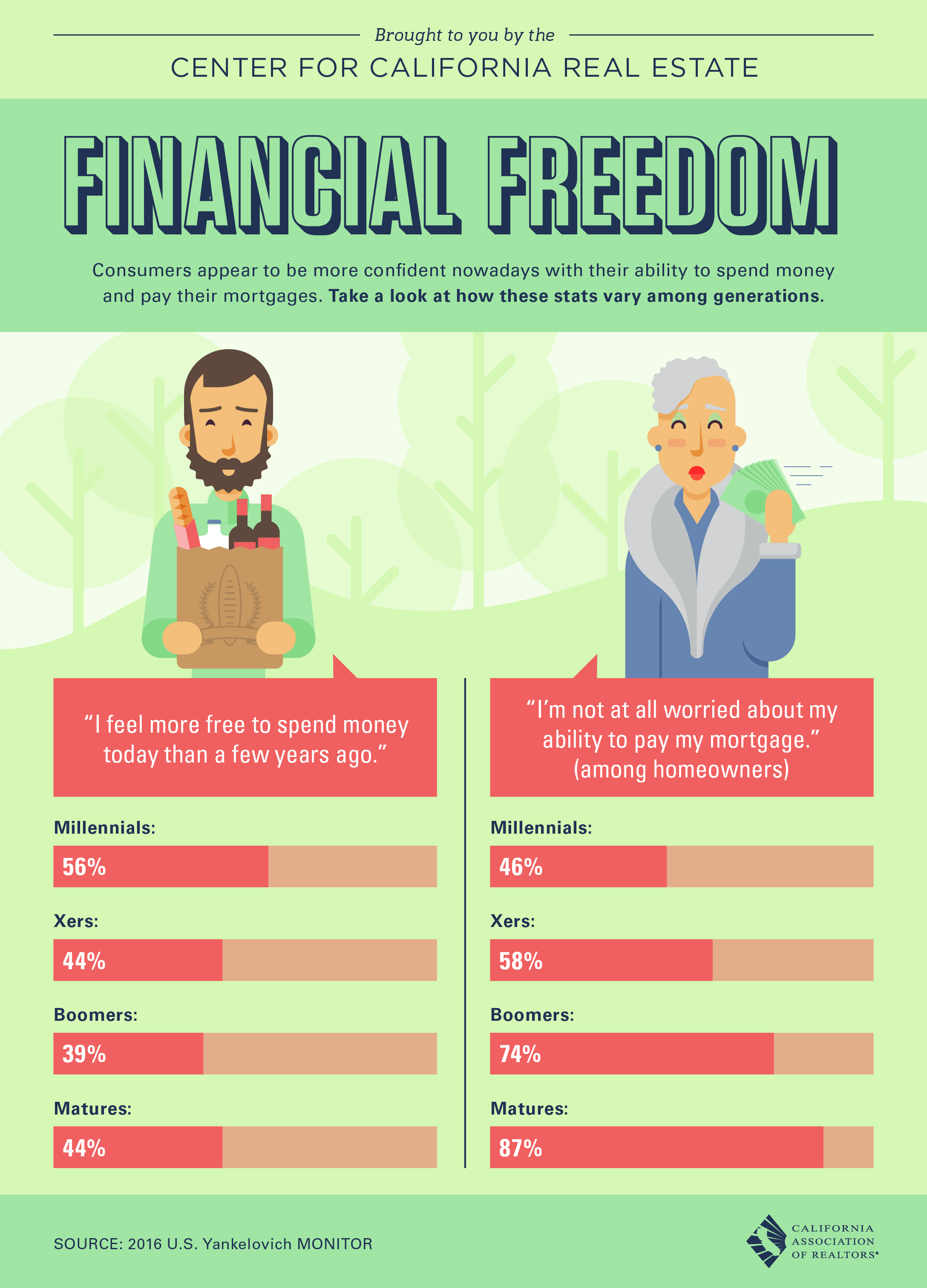

Great news for home buyers: confidence in homeownership is rising across all generations. From first-time millennial buyers to Gen X move-up purchasers to Baby Boomers investing in retirement properties, Americans see homeownership as a proven path to financial freedom.

This cross-generational confidence is more than just feel-good news—it's a powerful indicator of housing market stability. When buyer enthusiasm is concentrated in just one generation, markets become volatile. But when multiple generations participate actively, we see balanced demand, stable pricing, and sustainable growth.

Table of Contents

Why Cross-Generational Confidence Matters

Historically, housing markets struggle when they're too dependent on a single generation. In the early 2000s, the market was heavily driven by Baby Boomers and Gen X buyers, leading to overheating. When that demand collapsed, the entire market suffered.

Today's market is healthier because participation is distributed:

- Millennials (ages 28-43): Now the largest buyer demographic at 38% of all purchases, entering homeownership later but with strong conviction

- Gen X (ages 44-59): Making up 24% of buyers, often moving up to larger homes or investment properties

- Baby Boomers (ages 60-78): Still active at 14% of purchases, downsizing, relocating, or buying second homes

- Gen Z (ages 18-27): Emerging as 24% of buyers, the most ambitious first-time buyers on record

This balanced participation means no single generation carries the weight of the entire market. If one generation slows down, others continue driving demand. This creates the stability that benefits everyone—from first-time buyers to retirees.

Millennials: The Game-Changing Generation

For years, experts worried millennials would abandon homeownership in favor of renting and mobility. Those fears proved unfounded. Millennials are now the largest home-buying demographic, and their entry into the market has had a cascading stabilizing effect.

Why millennials matter so much:

- Sheer numbers: At 72+ million, millennials are the largest generation, creating sustained demand

- Life stage timing: Most are now 30-40 years old—prime home-buying years

- Remote work flexibility: Able to buy in more affordable markets while maintaining careers

- Financial motivation: After watching parents lose equity in 2008, they're cautious but committed to building wealth through real estate

As millennials move into starter homes, they create a ripple effect up the market chain. Current homeowners can sell to millennials and move up. Move-up buyers can purchase larger homes from downsizing Boomers. This circulation keeps inventory flowing and prices stable.

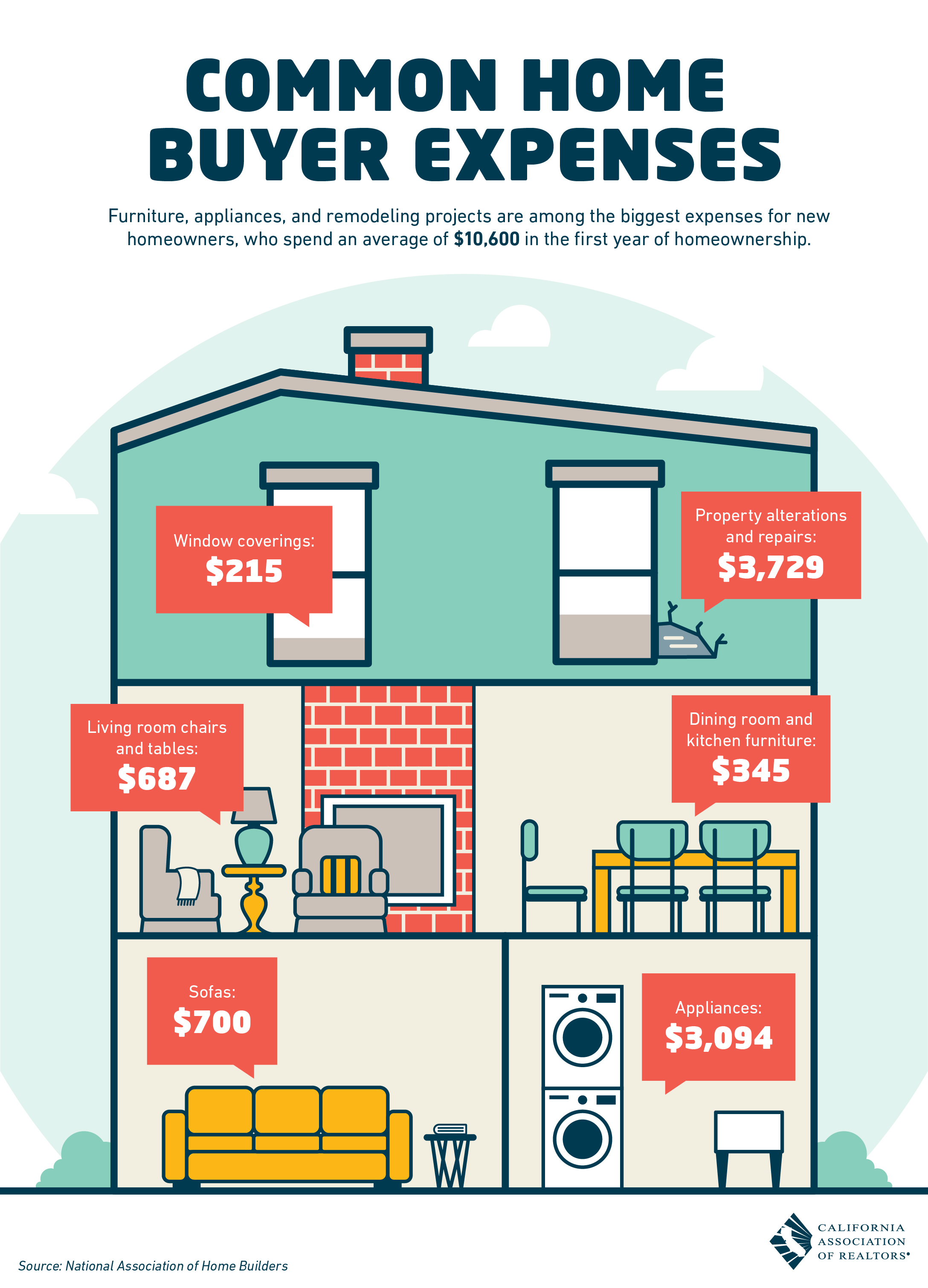

Many millennials are leveraging programs like FHA loans (3.5% down) to enter homeownership earlier than they thought possible. This is exactly the kind of smart financial planning that leads to long-term wealth building.

Gen X and Baby Boomers: Staying Active

Contrary to predictions that Boomers would flood the market with inventory by downsizing en masse, most are choosing to age in place or maintain active participation in real estate:

Gen X (Born 1965-1980)

Gen X buyers are in their peak earning years and using their financial stability to:

- Move up to larger homes to accommodate remote work and multigenerational living

- Purchase investment properties and vacation homes

- Refinance to take advantage of equity built over 10-20 years of ownership

- Help adult children with down payments while maintaining their own homeownership

Baby Boomers (Born 1946-1964)

Rather than exiting the market, many Boomers are:

- Choosing to age in place and renovate rather than downsize

- Purchasing second homes in retirement destinations

- Buying investment properties for income and legacy wealth

- Using reverse mortgages to access equity while staying in their homes

This continued participation means inventory remains balanced—not too much (causing price crashes) or too little (causing bidding wars).

What Cross-Generational Confidence Means for Market Stability

When buyers across all age groups feel confident about homeownership, several positive things happen:

1. Sustained Demand

With four generations actively buying, demand remains consistent even if one generation temporarily slows down. This prevents the boom-bust cycles that characterized past decades.

2. Inventory Circulation

As first-time buyers enter the market, current owners can move up or move on. This natural circulation prevents inventory shortages and keeps the market fluid.

3. Price Stability

Balanced demand across price points—from starter homes to luxury properties—prevents bubbles in any single market segment. Appreciation remains healthy but sustainable (typically 3-5% annually).

4. Lending Confidence

When lenders see diverse, confident buyers, they're more willing to offer competitive rates and flexible programs. This benefits everyone, especially first-time buyers who need the best possible terms.

Your Path to Financial Freedom Through Homeownership

So how do you join this confident, cross-generational movement toward financial freedom through homeownership?

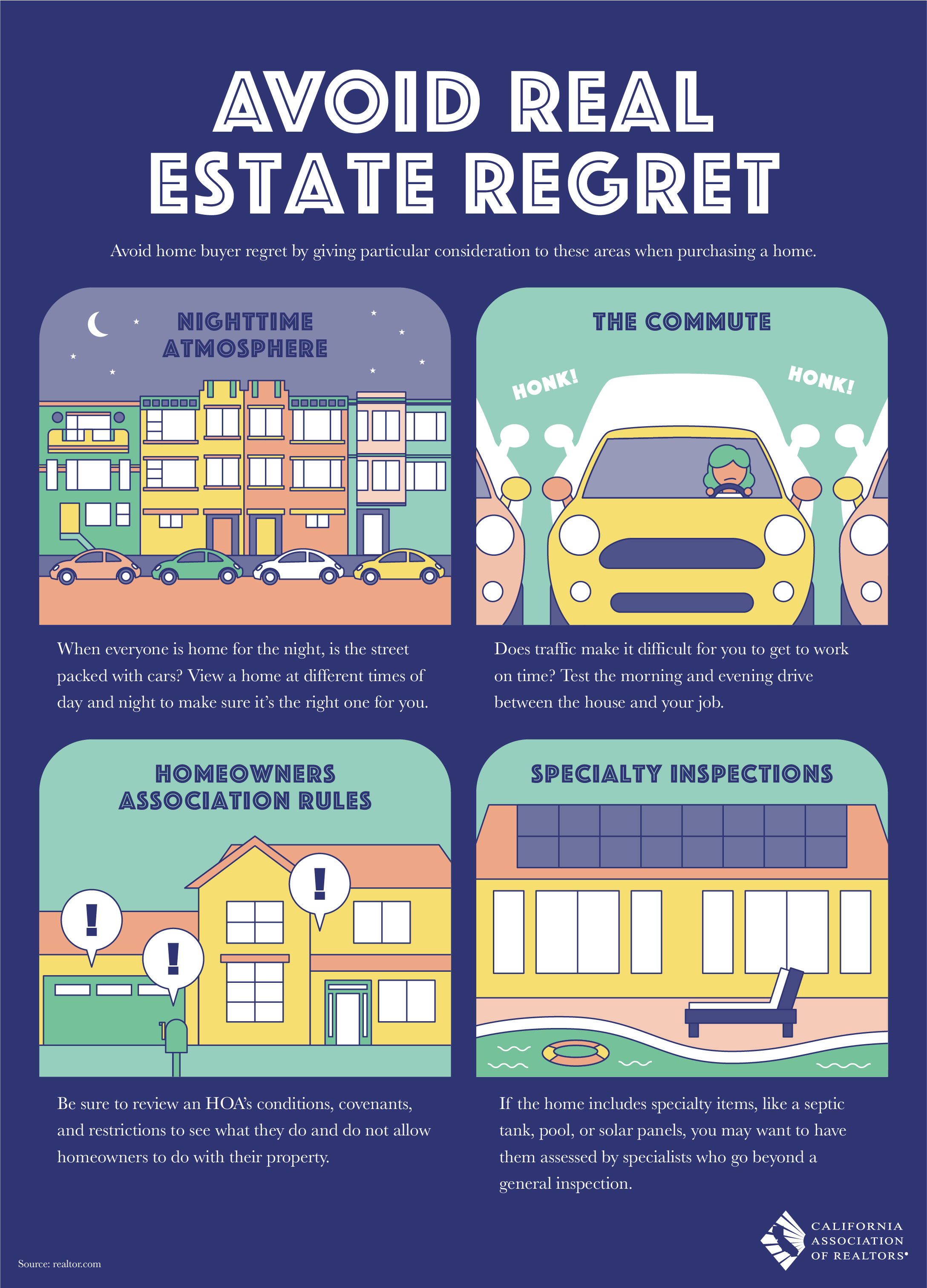

Step 1: Get Educated

Understand your options. Different generations benefit from different programs:

- First-time buyers: FHA loans, down payment assistance, first-time buyer grants

- Move-up buyers: Conventional loans, cash-out refinancing, bridge loans

- Investors: DSCR loans, portfolio loans, 1031 exchanges

- Retirees: Reverse mortgages, cash purchases, equity optimization

Step 2: Get Pre-Approved

Pre-approval accomplishes three things:

- Shows sellers you're a serious, qualified buyer

- Helps you understand your realistic budget

- Locks in your rate and terms so you can shop with confidence

Step 3: Take Action

Market conditions are never "perfect." Waiting for the ideal moment often means missing opportunities. If you're financially ready, have stable income, and plan to stay in an area for 3-5+ years, homeownership is likely your best path to building wealth.

Step 4: Build Wealth Over Time

Remember: homeownership is a long-term wealth-building strategy. Benefits compound over time:

- Years 1-5: Build equity through payments and appreciation

- Years 5-10: Significant equity allows refinancing or leveraging for investments

- Years 10-20: Major equity position, mortgage paydown, substantial net worth increase

- Years 20-30: Mortgage paid off, own home free and clear, massive wealth transfer to next generation

Financial Freedom Starts with Homeownership

The data is clear: Americans across all generations believe in homeownership as a path to financial freedom. This isn't blind optimism—it's based on decades of evidence showing that homeowners build wealth, enjoy stability, and create legacies for their families.

Whether you're a millennial buying your first home, a Gen Xer moving up, or a Boomer investing in your future, now is the time to take control of your financial destiny through real estate.