Buying a home is exciting. Whether you're purchasing a brand new house or a fixer-upper begging for renovations, this is your chance to stamp your own style and transform a house into your home. But in that excitement, many first-time buyers make a costly mistake: underestimating how much they'll need for furnishings, moving costs, and immediate home expenses.

Don't let that happen to you. Even if cash or down payment is tight, there are smart ways to structure your purchase offer and financing terms to preserve cash flow for making your home truly yours.

Table of Contents

Hidden Costs Buyers Often Overlook

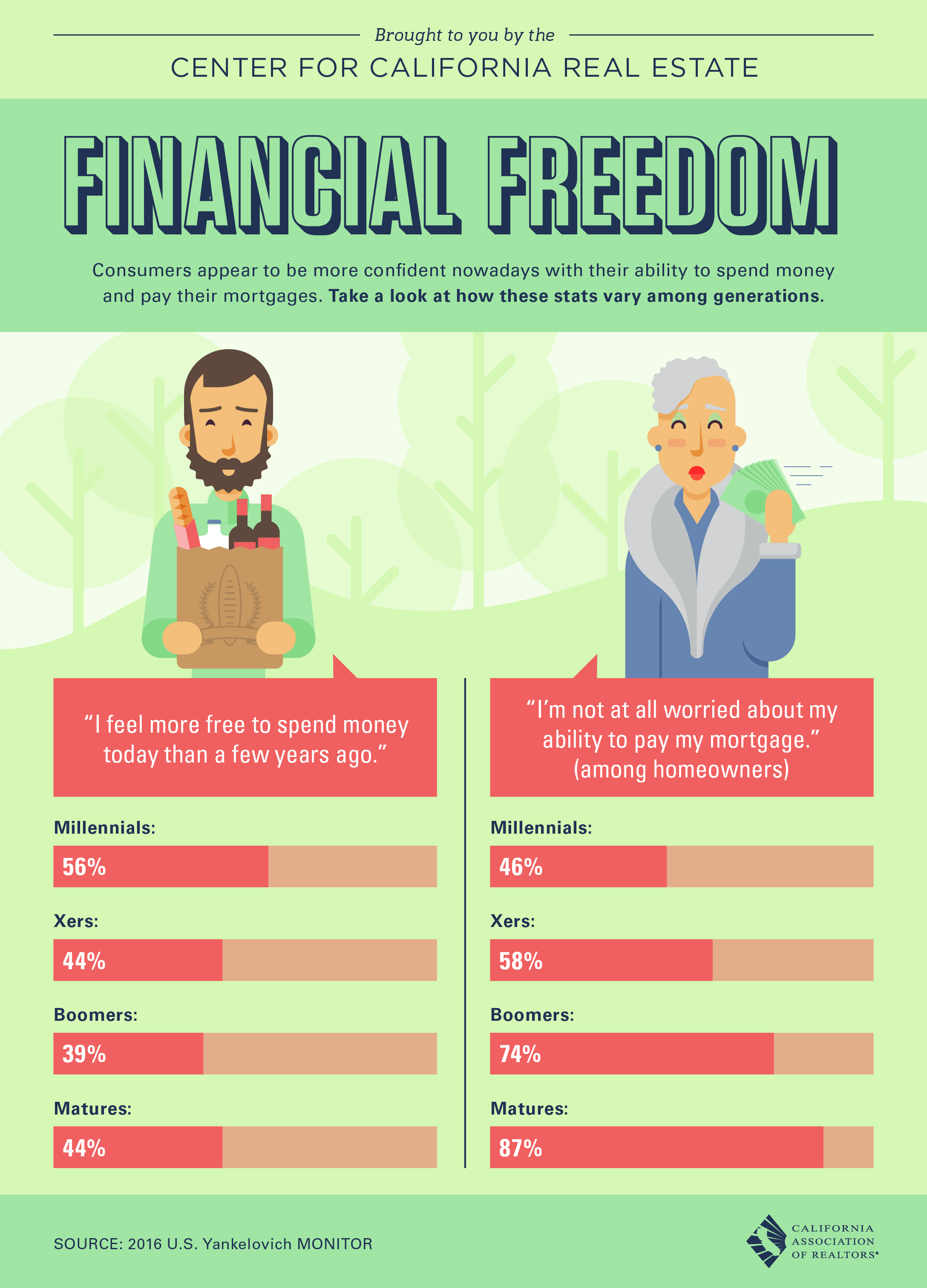

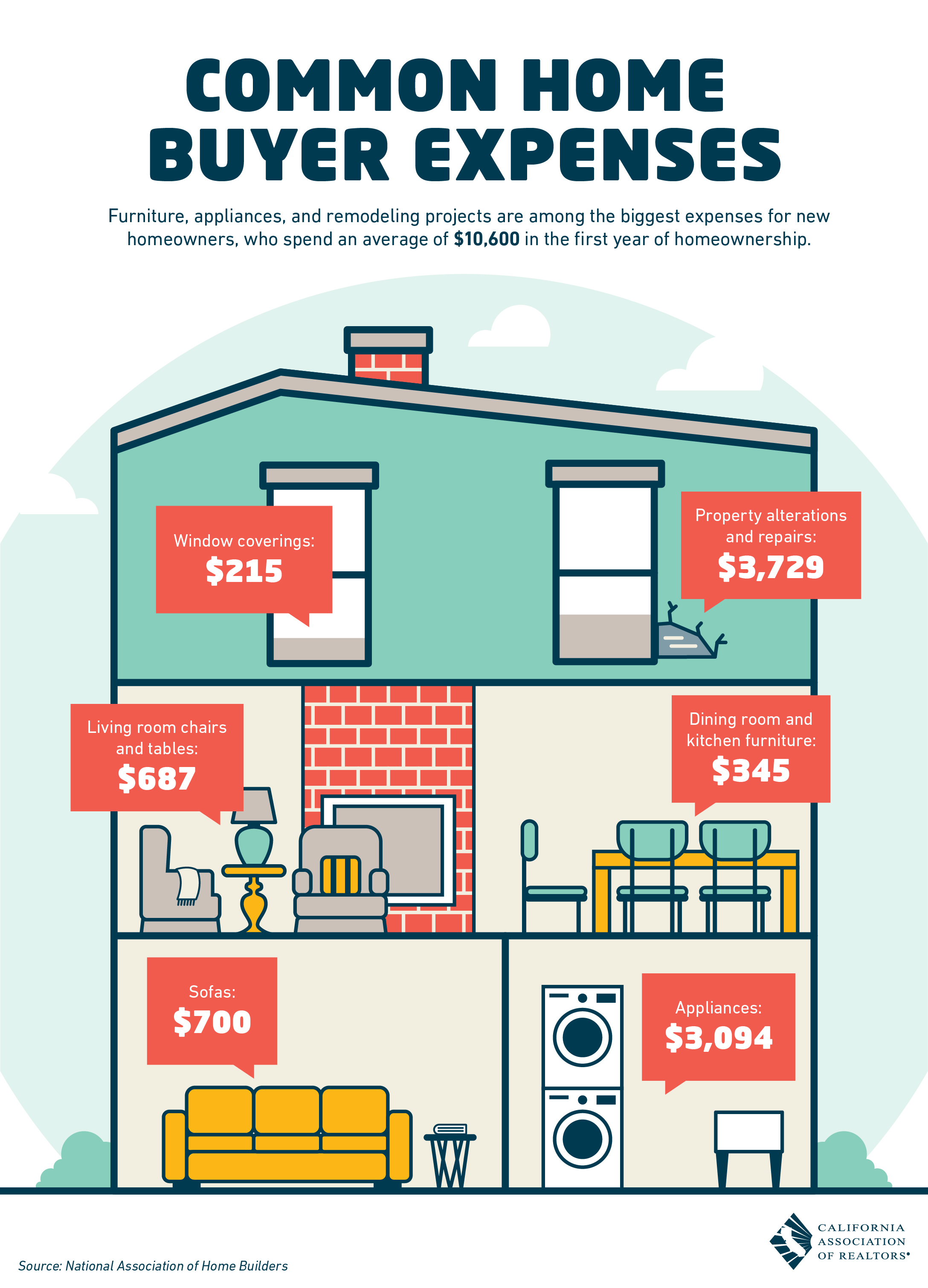

Most buyers budget for down payment and closing costs—but the expenses don't stop there. Here's what catches many buyers off guard:

- Furnishings and decor: $5,000-$15,000+ depending on how much you already own

- Window treatments: Blinds, curtains, and shades for an entire house add up quickly ($1,000-$3,000)

- Moving costs: Professional movers, truck rentals, supplies ($1,000-$5,000)

- Immediate repairs: Things that need fixing right away ($2,000-$10,000)

- Utility setup and deposits: Electric, gas, water, internet, security ($500-$1,500)

- Lawn and garden equipment: Mower, tools, hoses ($500-$2,000)

- Basic appliances: If not included (washer, dryer, fridge) ($2,000-$5,000)

Add it up, and you're easily looking at $10,000-$30,000 in post-closing expenses. Most buyers underestimate this by at least 30%. The solution? Plan ahead and structure your deal to maximize available cash.

How to Use Seller Credits Strategically

Timing is paramount. Waiting until after your offer is accepted to ask for financial help is too late. You need to build these strategies into your initial offer.

One underutilized tactic is to request seller credits for closing costs. Here's how it works:

- Instead of offering $300,000 with no seller concessions, offer $306,000 with a $6,000 seller credit

- The seller nets the same amount ($300,000)

- You keep $6,000 of your cash for furnishings and moving instead of paying it toward closing costs

- Your lender finances the closing costs into your mortgage (at today's low rates)

Don't be afraid to do this even in a seller's market. If you present a strong offer otherwise—solid pre-approval from a lender like Breeze Funding, minimal contingencies, flexible closing date—many sellers will agree to reasonable credits to secure a reliable buyer.

Lender Credits and Grant Programs

Beyond seller credits, you have other options to preserve cash:

Lender Credits

Some lenders offer credits toward your closing costs in exchange for a slightly higher interest rate. This can make sense if:

- You're cash-strapped now but expect income to increase

- You plan to refinance in 3-5 years anyway

- Preserving cash now is more valuable than a 0.125-0.25% rate difference

Down Payment Assistance & Grant Programs

Dozens of programs exist to help buyers, including:

- FHA loans: Just 3.5% down payment required

- VA loans: 0% down for eligible veterans and active military

- USDA loans: 0% down for rural and suburban properties

- State and local programs: First-time buyer grants, often $5,000-$15,000

- Employer programs: Many companies offer housing assistance to employees

- Non-profit organizations: Down payment assistance for qualified buyers

We help our clients navigate these programs daily. Many buyers don't realize they qualify for assistance that could save them thousands.

Why Timing Matters in Negotiations

Here's the key takeaway: structuring your offer correctly from the start is critical. Once you're under contract, your negotiating power diminishes significantly. Asking for seller credits or exploring grant programs after acceptance is difficult or impossible.

The right sequence:

- Get pre-approved: Talk to your lender about all available programs and strategies

- Understand your full budget: Not just mortgage payment, but post-closing cash needs

- Structure your offer accordingly: Build in seller credits, choose the right loan program

- Close with confidence: Knowing you have cash flow for furniture, repairs, and emergencies

Make Your Home Truly Yours

Buying a home should be exciting—not stressful because you've depleted all your savings on the purchase. By planning ahead and working with experienced professionals who understand creative financing strategies, you can close on your dream home and have the cash flow to make it your own.