Be mortgage free: Apply for a Reverse Mortgage!

Check My EligibilityWhy reverse mortgage?

- Eliminate Mortgage Payment

- Increase Cash Flow

- Leverage your home's rising equity with line of credit

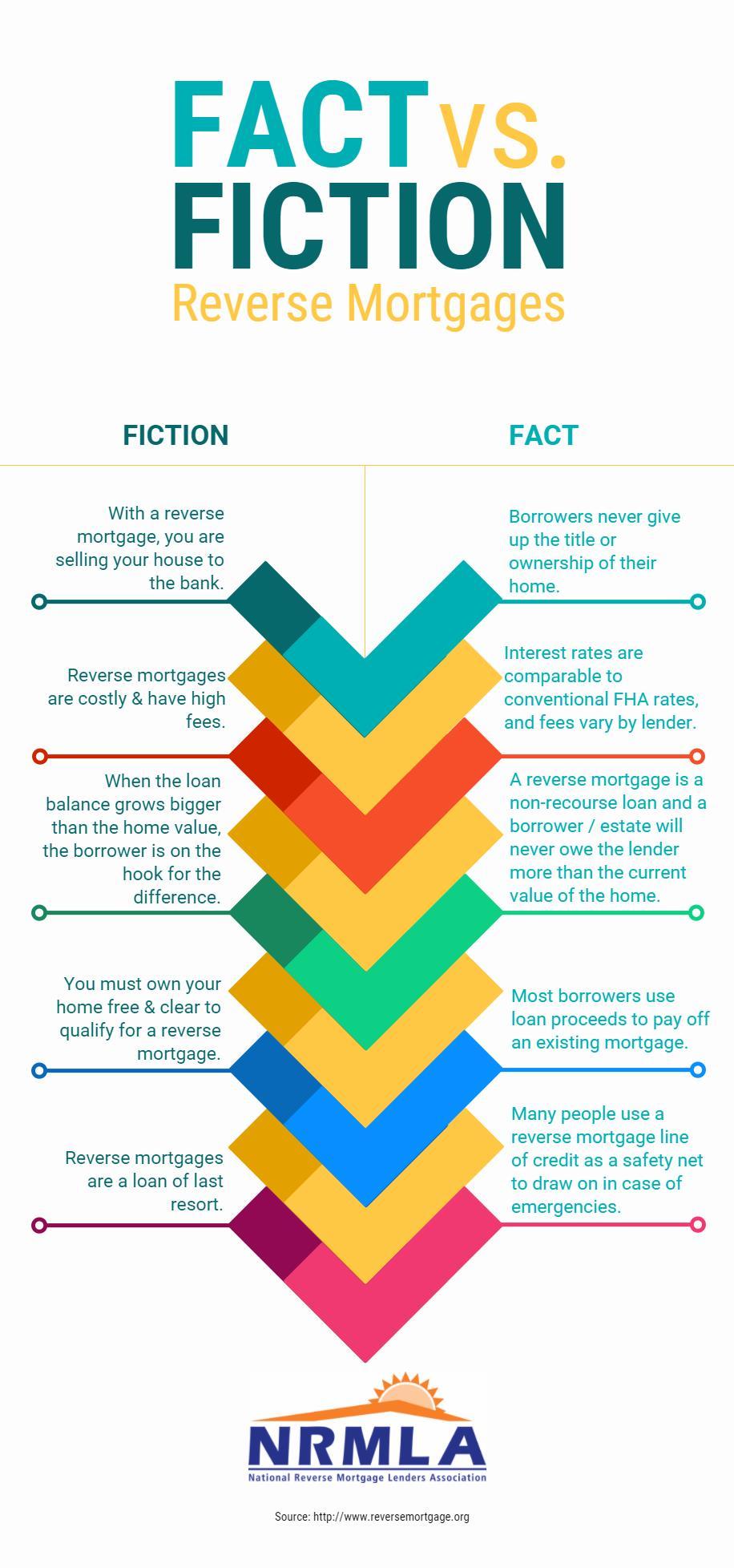

Reverse mortgages allow homeowners 62+ to convert home equity into tax-free cash with no monthly mortgage payments. You retain ownership and can never owe more than your home's value. The loan is repaid when you sell, move, or pass away, with any remaining equity going to your heirs.

The Reverse Mortgage Process: 5 Easy Steps

Prequalify

Talk to one of our reverse mortgage specialists and see if you may qualify instantly. We will need to know your age, approximate value of your home, and how much you currently owe on it.

HUD Counseling

All prospective reverse borrower's are required to complete a counseling session with a neutral 3rd party approved by HUD

Application and Documents

Once counseling is completed, you receive an application package based on the loan type you selected. You will provide required information required for financial assessment including income documentation if any. While credit scores are not relied on, credit history is required to assess whether things such as property taxes and insurance need to be included in the loan.

Underwriting

Property value will be determined by a local appraiser. Underwriter will review financial assessment, any liens on the property, and the amount of proceeds the loan will provide among other things.

Loan Funding

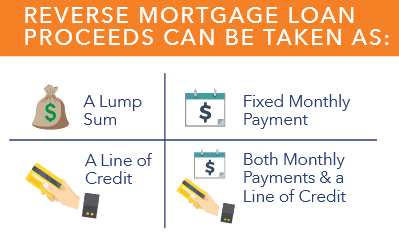

Final loan documents are signed with a notary and loan funds. Borrower may have immediate access to proceeds depending on loan type selected.

People Also Ask

Can I lose my home with a reverse mortgage?

No, you cannot lose your home as long as you live in it as your primary residence, pay property taxes and insurance, and maintain the property. You retain full ownership. The loan only becomes due when you permanently leave the home or pass away.

How much money can I get from a reverse mortgage?

Typically 50-75% of your home's value, depending on your age (older = more money), home value, interest rates, and existing mortgage balance. A 75-year-old with a $500,000 home might access $250,000-$350,000. We'll calculate your exact amount for free.

Do I have to make monthly payments on a reverse mortgage?

No monthly mortgage payments are required. The loan balance grows over time as interest accrues. You must still pay property taxes, homeowners insurance, and maintain the home, but there are no mortgage payments for as long as you live there.

What happens to my reverse mortgage when I die?

Your heirs can pay off the loan balance (typically 95% of appraised value) to keep the home, or sell it and keep any remaining equity. If the loan exceeds the home's value, FHA insurance covers the difference—heirs never owe more than the home is worth.

Reverse Mortgage Key Terms

- HECM (Home Equity Conversion Mortgage)

- The most common type of reverse mortgage, insured by FHA. Allows homeowners 62+ to access home equity with government protections, including non-recourse features and regulated fees.

- Line of Credit Option

- A reverse mortgage option that provides access to funds as needed rather than all at once. The unused portion grows over time, giving you increasing borrowing power for emergencies or future expenses.

- Tenure Payments

- Monthly payments from your reverse mortgage that continue as long as you live in the home. Provides guaranteed income stream, like a pension, for life. Popular option for supplementing retirement income.

- Principal Limit

- The maximum amount you can borrow with a reverse mortgage, calculated based on your age, home value, interest rates, and FHA lending limits. Older borrowers and higher home values yield higher principal limits.

- Non-Recourse Loan

- Protection ensuring you or your heirs will never owe more than the home's value when the loan is due. If the loan balance exceeds the property value, FHA insurance covers the difference.

Reverse Mortgage vs Home Equity Loan

Understanding your options for accessing home equity

| Feature | Reverse Mortgage | Home Equity Loan |

|---|---|---|

| Monthly Payments | ✓ None required | ✗ Required monthly payments |

| Age Requirement | Must be 62+ | No age requirement |

| Income Verification | ✓ Minimal | ✗ Full documentation required |

| Repayment | When you sell, move, or pass away | Fixed term (5-30 years) |

| Loan Balance | Increases over time with interest | Decreases as you pay down |

| Best For | Retirees wanting to eliminate payments | Working homeowners with steady income |

| Mortgage Insurance | Required (FHA insured) | Not required |

| Interest Rates | Typically higher | Typically lower |

Not sure which option is right for you? Our reverse mortgage specialists can help you compare your options and determine the best solution for your financial goals.

Compare My Options