Critical Considerations Before Buying Your Next Home

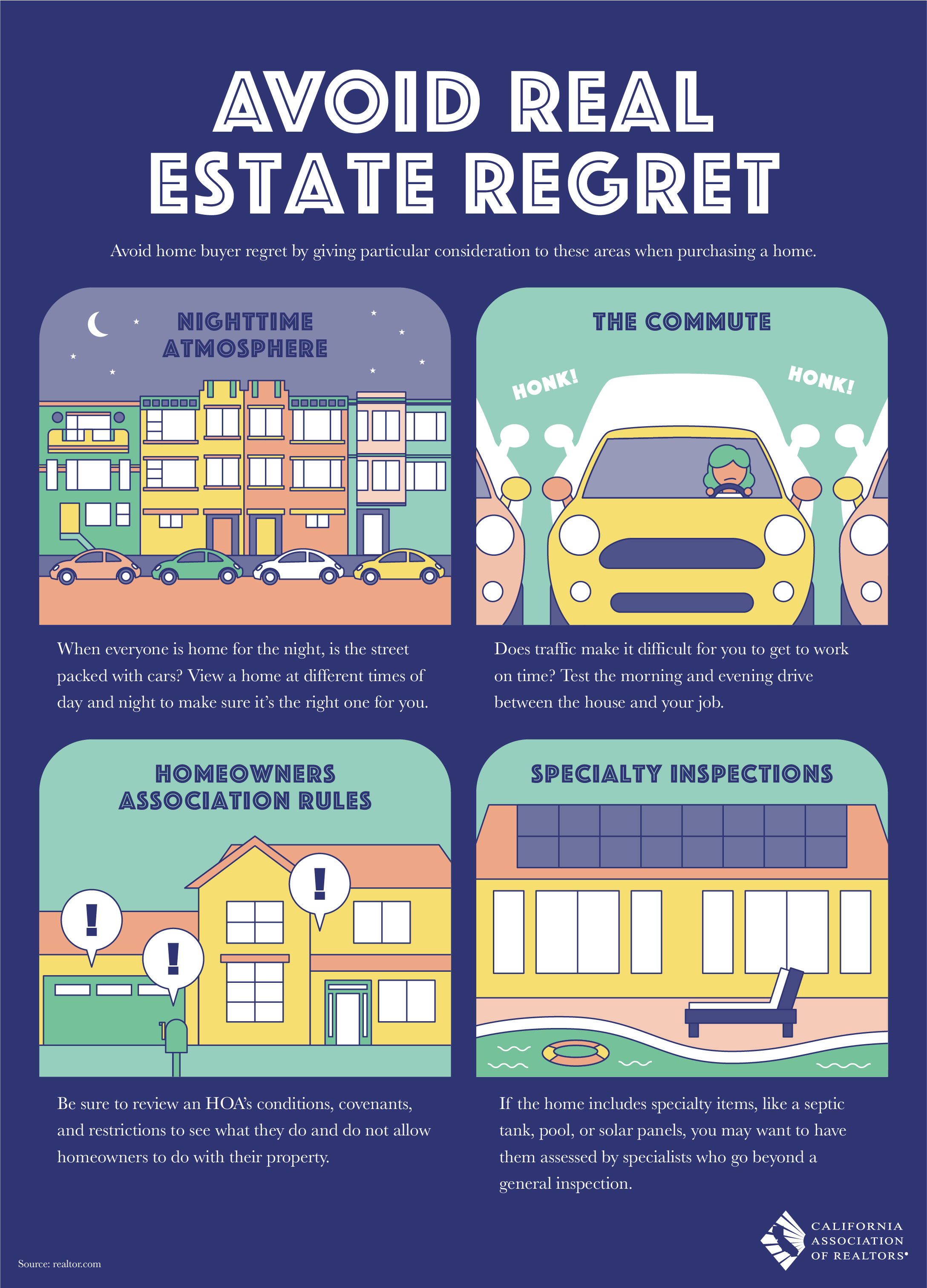

Avoid making a disastrous mistake! There are lots of reasons to buy a certain home, but often times, there are just as many reasons WHY YOU SHOULD NOT BUY THAT HOME. Of course, some of the most important considerations have to do with the physical condition of the property. Too often, however, prospective homeowners overlook some key considerations that can be the defining point between you living in bliss and living a nightmare.

Before you sign that purchase agreement, make sure you thoroughly evaluate these often-overlooked factors that can make or break your homeownership experience.

Table of Contents

Test Your Commute Before You Commit

Often in the excitement of owning our own home, we can get sucked into buying in a place that requires a traffic-congested commute. Unless you have an option for some flexibility and/or are able to work from home, you should definitely test out the commute—multiple times, at different times of day.

Why This Matters:

- Time is Money: A 90-minute daily commute (45 minutes each way) equals 7.5 hours per week, 390 hours per year—that's 16 full days spent in your car annually

- Quality of Life: Long commutes correlate with higher stress, less exercise, worse sleep, and reduced family time

- Financial Impact: Extra gas, maintenance, and vehicle wear can cost $3,000-$5,000+ annually for long commutes

- Career Flexibility: Remote work policies can change—if your employer requires office return, that 'occasional commute' becomes daily reality

Action Steps:

- Drive the route during actual commute times (7-9am, 4-6pm on weekdays)

- Test it on both sunny days and during rain/snow if applicable

- Check for construction projects that might worsen traffic

- Research public transit options and reliability

- Factor in school drop-off times if you have children

Parking: The Hidden Deal-Breaker

If you are considering buying in a densely populated or business zone area, make sure you visit the site at different times of the day and both during the week and weekends. Sometimes a quiet area on the weekend can turn into a parking zoo during the week if local businesses share the parking space.

Common Parking Nightmares:

- Business District Living: Residential streets near offices/restaurants become parking lots during business hours

- Event Venues: Living near stadiums, concert halls, or universities means impossible parking during events

- Limited Guest Parking: Condos/townhomes often restrict guest parking—your visitors may have nowhere to park

- Tandem Garages: If you need to move one car to access another daily, this gets old fast

- Street Cleaning/Snow Removal: Weekly street parking bans require constant car shuffling

What to Check:

- Visit weekday mornings, afternoons, and evenings

- Check weekend parking availability

- Verify assigned vs. first-come parking in HOAs

- Count available guest parking spaces

- Review city parking restrictions (permits, time limits, street cleaning)

HOA Restrictions: Read the Fine Print

One place where you should definitely read the fine print is your Homeowners Association rules and restrictions. Find the HOA that fits your personality and lifestyle. If you love living in an area where everything is uniform and always manicured to perfection, you may prefer a stricter association so you don't have to stress over that weird garden art on your neighbor's front lawn. Alternatively, if you want more freedom and a care-free living environment, make sure you don't end up living in an HOA that won't even let you put the plant of your choice on your own balcony.

Critical HOA Documents to Review:

- CC&Rs (Covenants, Conditions & Restrictions): The rulebook governing what you can/cannot do with your property

- Financial Statements: Verify the HOA has adequate reserves (70%+ funded is healthy)

- Meeting Minutes (last 12 months): Reveals disputes, upcoming special assessments, and board dysfunction

- Delinquency Report: High delinquency rates (30%+) indicate financial trouble ahead

- Insurance Policies: Confirm adequate liability and property coverage

Common HOA Restrictions to Watch For:

- Pet restrictions (breed, size, number limits)

- Rental restrictions (some HOAs prohibit or limit rentals)

- Vehicle restrictions (no RVs, boats, work trucks, or parking in driveways)

- Landscaping requirements (specific plants, maintenance schedules)

- Exterior modifications (paint colors, window coverings, holiday decorations)

- Solar panel prohibitions (some HOAs still restrict them)

Red Flags: Special assessments planned or recently passed, multiple lawsuits, high turnover of board members, deferred maintenance on common areas, or vague/inconsistently enforced rules.

Specialized Inspections You Can't Skip

Inspections on high-priced amenities or other items are critical. Some examples include a pool, solar paneling, or specialized outlets for your electric vehicle. Make sure these items and other add-ons from previous owners are up to code to avoid costly retrofits.

Essential Specialized Inspections:

1. Sewer Scope Inspection ($200-$400)

Critical for homes 25+ years old. Camera inspection identifies root intrusion, cracks, or collapsed pipes. Sewer line replacement costs $3,000-$15,000—this $300 inspection can save you from inheriting a disaster.

2. Solar Panel Inspection ($300-$500)

Verify: ownership vs. lease (leases complicate selling), warranty transfers, system age/condition, roof condition under panels (removing/reinstalling panels for roof work costs $2,000-$5,000), and actual energy production vs. claims. Learn more about solar panel issues.

3. Pool/Spa Inspection ($200-$400)

Checks pumps, heaters, filters, structural integrity, and code compliance. Pool repairs run $1,000-$10,000+. New pool heaters alone cost $2,000-$5,000.

4. Mold/Environmental Testing ($300-$800)

If you see water stains, smell mustiness, or the home has flooding history, test for mold and air quality. Mold remediation costs $2,000-$10,000 depending on extent.

5. Foundation Specialist ($400-$800)

If the general inspector notes foundation concerns (cracks, uneven floors, sticking doors), hire a structural engineer. Foundation repairs range $3,000-$30,000+.

6. Roof Inspection ($150-$350)

Even if the roof looks fine from the ground, have an expert evaluate remaining lifespan. New roofs cost $8,000-$25,000+. Knowing you'll need replacement in 2-3 years affects your offer price.

Don't Skip Inspections to Save Money: Spending $1,500-$2,500 on comprehensive inspections can save you $20,000-$50,000 in unexpected repairs. Plus, inspection findings give you negotiating leverage—sellers often credit repair costs or reduce the purchase price.

Additional Critical Considerations

Beyond the essentials above, don't overlook these deal-breakers:

- Neighborhood Research: Visit at different times (weekdays, weekends, late evenings) to assess noise, traffic, and activity levels

- School Districts: Even if you don't have kids, good schools boost resale value 15-20%

- Future Development: Check city planning for proposed developments (highways, commercial projects) that could affect your property

- Insurance Costs: Get actual quotes before buying—flood zones, wildfire areas, and older homes can have shockingly high premiums

- Property Taxes: Verify actual tax bills, not estimated—some areas reassess at purchase price, dramatically increasing taxes

- Utilities & Internet: Confirm high-speed internet availability (critical for remote work) and average utility costs

Don't Let Excitement Cloud Your Judgment

Buying a home is one of the biggest financial decisions you'll ever make. While it's easy to get swept up in the excitement of finding "the one," taking time to thoroughly evaluate these practical considerations can save you from buyer's remorse, financial stress, and an eventual costly move.

Remember: the perfect house in the wrong location, with the wrong commute, or with hidden expensive problems is not the perfect house. Be methodical, do your research, and don't be afraid to walk away if red flags appear.