Smart Spending Beats Debt Paranoia: The Strategic Approach to Building Wealth

Ahhh the eternal question: Should you live it up, racking up debt carefree while you are alive because you only live once? Or should you be carefully crafting your future financial freedom because in the end that is how wealth is created? Well a new study has some surprising results. In the end, maybe it just comes down to math—maybe it doesn't have to be one or the other.

Here's the secret formula to live it up and plan your future, SUCCESSFULLY. It's not even about the boring balance of save some, spend some. It's all about spending right.

Table of Contents

The Real Problem: Not All Debt Is Equal

The financial advice industry loves to preach "all debt is bad." But that's oversimplified and frankly, wrong. The wealthy understand something most people don't: strategic debt builds wealth, while bad debt destroys it. The difference? Interest rates, tax treatment, and what you're financing.

According to creditcard.com, the current average credit card interest rate hovers around 15%—and many cards charge 20-25% or more. But here's where it gets worse: most credit cards compound interest on a daily basis, meaning you end up paying interest on the interest you are paying, often resulting in you paying exponentially more than where you started.

Meanwhile, mortgage interest rates sit around 6.5-7.5% (as of late 2025), auto loans around 5-8%, and student loans around 4-7%. The gap is massive—and that gap represents the difference between building wealth and hemorrhaging money.

Compound Interest vs. Simple Interest: The Math That Changes Everything

Compound interest (used by credit cards) means you pay interest on both the principal AND accumulated interest. It multiplies exponentially:

- $10,000 credit card balance at 18% APR

- Making minimum payments ($200/month)

- Takes 14 years to pay off

- Total interest paid: $13,000+

- You paid $23,000 for $10,000 in purchases

Simple interest (used by mortgages and car loans) means you pay interest only on the original principal. Examples of simple interest include installment debts like mortgages and cars:

- $400,000 mortgage at 6.5% (30-year fixed)

- Monthly payment: $2,528

- Total interest paid: $510,000 over 30 years

- But you build $400,000+ in equity as the home appreciates

- Plus you deduct mortgage interest on taxes (worth $10,000-$15,000/year)

- Net result: wealth accumulation, not wealth destruction

Good Debt vs. Bad Debt: Making Strategic Choices

So that fabulous home you just bought to live it up is probably a much better investment than the credit card debt you are racking up for outside meals, clothes, and gadgets. Some items you buy as an installment debt with simple interest often have the added advantage of appreciating in value and money-saving tax deductions.

Good Debt Characteristics:

- Low interest rates: Under 8%, ideally under 6%

- Tax advantages: Mortgage interest deduction is the highest deduction for homeowners—that means for your residence and your rental properties

- Appreciating assets: Homes typically appreciate 3-5% annually

- Wealth building: Each payment builds equity you can access later

- Predictable payments: Fixed-rate loans never change, making budgeting easier

Bad Debt Characteristics:

- High interest rates: 15%+ compound interest

- No tax benefits: Credit card interest isn't deductible

- Depreciating purchases: That $2,000 TV is worth $500 in a year

- Minimum payments trap: Designed to keep you in debt forever

- Variable rates: Can increase without warning

The takeaway? Don't avoid all debt—avoid bad debt. Strategic use of low-interest, tax-advantaged debt to buy appreciating assets is exactly how wealthy people build wealth.

Debt Consolidation: Your Path to Financial Freedom

If you do have credit card debts, consider reorganizing them into one lower fixed rate to save you more money that you can put toward your financially free future. This is where understanding the math really pays off.

The Debt Consolidation Advantage:

Let's say you have $30,000 in credit card debt at an average 18% APR. Your minimum payments total about $450/month, and you'll be paying that for 14+ years while accumulating $27,000 in interest charges.

Now consider consolidating through a cash-out refinance or home equity loan at 7% interest:

- $30,000 added to your mortgage

- Payment increase: only $190/month

- Savings: $260/month

- Total interest saved: $20,000+ over loan life

- Mortgage interest is tax-deductible (credit card interest isn't)

- Fixed payment that never changes (vs. variable credit card rates)

We help clients structure these transactions at Breeze Funding all the time. The key is combining the consolidation with a commitment not to run up the credit cards again. Otherwise, you've just converted one problem into a bigger one.

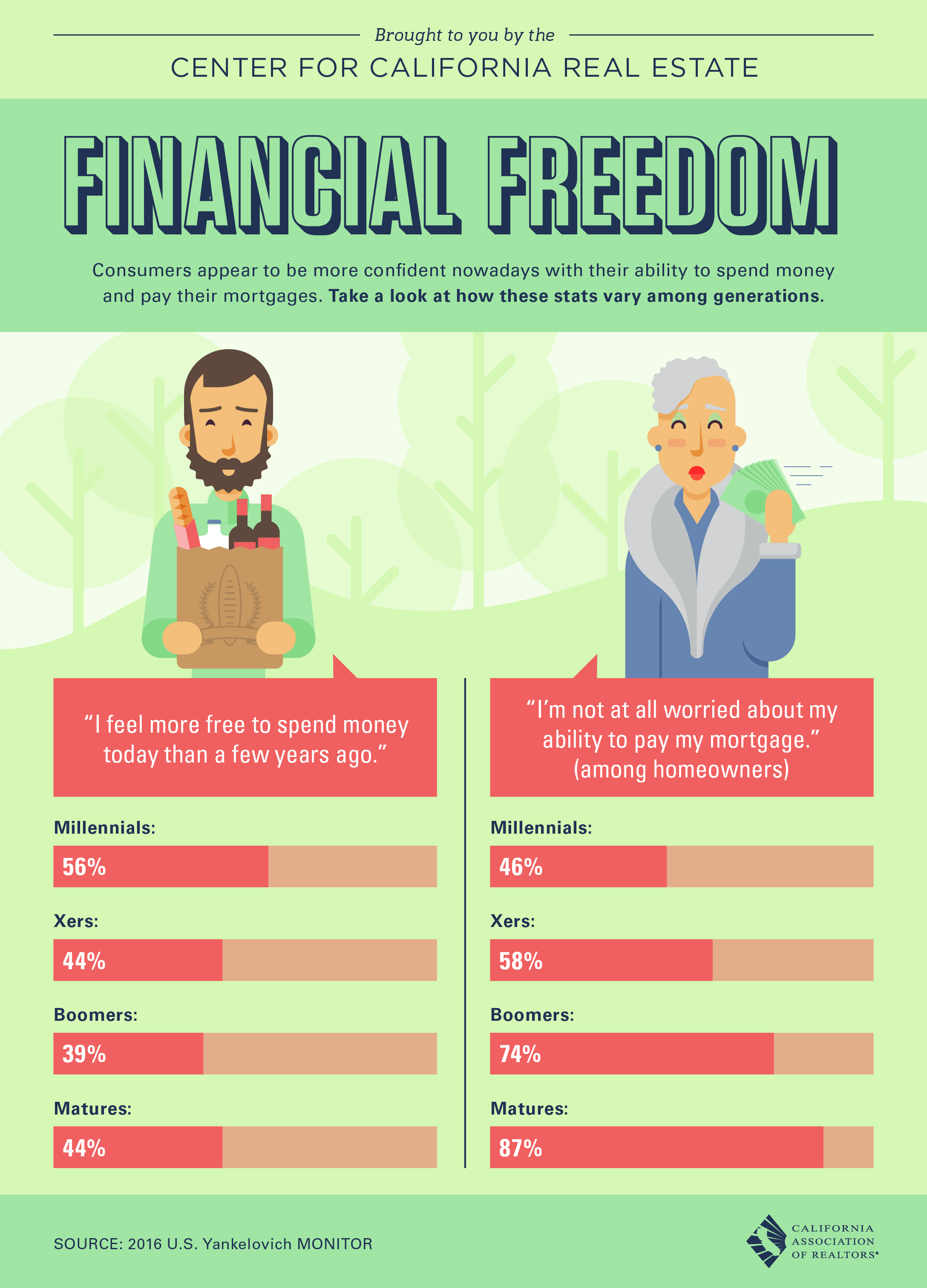

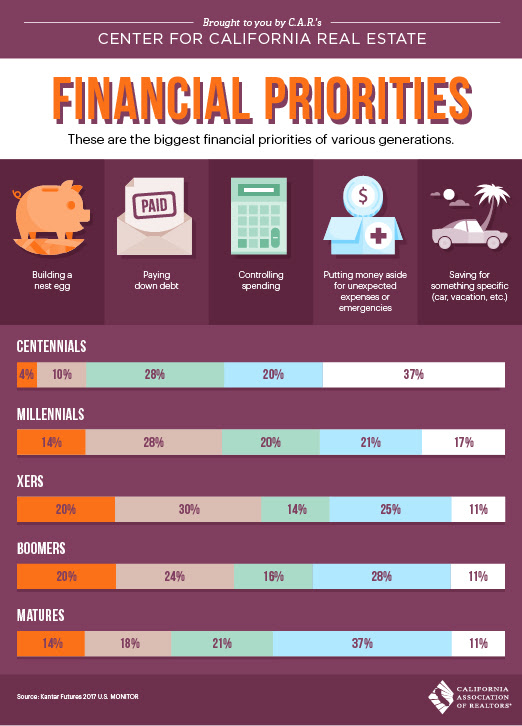

Generational Spending Priorities: Check out how different generations prioritize financially:

The Bottom Line: Spend Smart, Not Less

The old advice to "spend less and save more" misses the point. The real secret is spending strategically:

- Use low-interest debt for appreciating assets (homes, investment properties)

- Avoid high-interest debt for depreciating purchases (consumer goods, vacations)

- Consolidate existing high-interest debt into lower fixed rates

- Maximize tax-advantaged debt (mortgage interest deduction)

- Build equity through homeownership rather than renting forever

So there you go: don't skimp, just be smart about the numbers. Live well today while building wealth for tomorrow—by understanding the math that separates good debt from bad debt.