"I don't care what you know until I know that what you care." It's an old saying, but it's a classic sentiment. Now, new research shows that homeowners are putting their money behind the idea. In today's market, choosing a mortgage lender isn't just about rates—it's about values, trust, and community.

Table of Contents

Why Brand Values Matter in Mortgage Lending

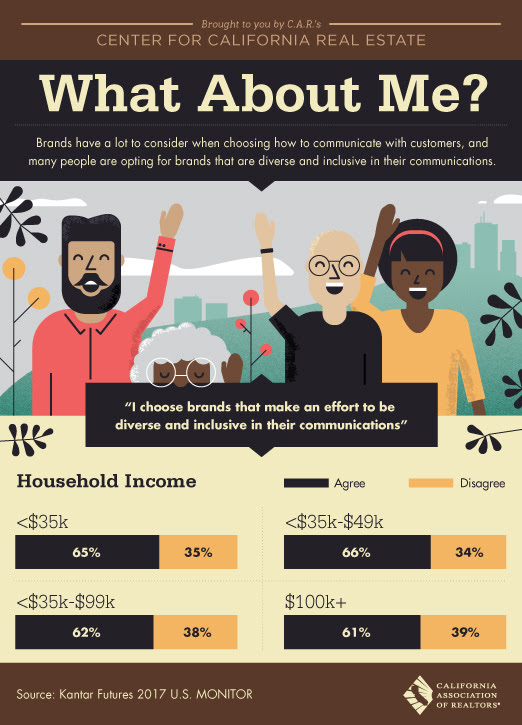

Across the board, people with varying household incomes agree that the message behind the brand matters. More than 60% of respondents said, "I choose brands that make an effort to be diverse and inclusive in their communications." This trend is especially strong in the home buying process, where trust and alignment matter most.

When you're making one of the biggest financial decisions of your life, you want to work with people who see you, understand your unique situation, and genuinely care about your success. Cost will always be a factor, but it's no longer the only factor. Today's homebuyers want partners who invest in more than just their bottom line.

Diversity and Inclusion Drive Real Decisions

The data is clear: consumers—especially millennials and Gen Z—actively seek out companies that demonstrate diversity and inclusion in their practices, not just their marketing. This means:

- Representation matters: Buyers want to see themselves reflected in the companies they work with

- Accessibility counts: From multilingual support to programs for first-time buyers with lower credit scores, inclusive lenders remove barriers

- Community involvement speaks volumes: Lenders who give back to local communities earn lasting trust and loyalty

At Breeze Funding, we've built our business on these principles since 2012. We believe everyone deserves access to homeownership, regardless of background, and we work tirelessly to find loan solutions that fit each unique situation.

Community Impact Beyond the Transaction

People want to work with companies and people who care about them and their community. This goes beyond closing a loan—it's about:

- Supporting local economies and neighborhoods

- Educating buyers about financial wellness and homeownership

- Creating lasting relationships that extend beyond the purchase

- Advocating for fair lending practices and equal access

When your lender is invested in your community's success, everyone benefits. That's why we focus on long-term partnerships, not one-time transactions.

How to Choose a Mortgage Lender That Aligns With Your Values

When evaluating mortgage lenders, look beyond the rate sheet. Ask yourself:

- Does this company demonstrate diversity in their team and marketing?

- Do they offer programs that serve a wide range of borrowers, including those with unique circumstances?

- Are they transparent about fees, processes, and expectations?

- Do they invest in community education and resources?

- Do their reviews reflect respect, care, and genuine support?

The bottom line: Show that you care, or nobody will care. And as a borrower, choose lenders who show they care about you—not just your loan amount.